Introduction

During the course of President Andrew Jackson’s political conflict with the Second Bank of the United States—the famous “Bank War” that helped define Jackson’s presidency and contributed to the development of the Second Party System of Democrats and Whigs—many of Jackson’s allies argued that the Bank was ultimately harmful to the economic interests of southerners and westerners.[1] Yet in a number of important ways, the Bank (BUS) provided the credit facilities that helped enable the rapid expansion of land, cotton, and slavery then under way in the Old Southwest.[2]

Historians of capitalism in recent years have reexamined with fresh eyes the complex credit relationships that fueled the global cotton trade and larger industrial revolution, often by highlighting structural inequalities and previously neglected actors who toiled somewhere on the lower end of the spectrum of unfree labor.[3] Despite the significant attention devoted to a number of northern and British financial institutions within this literature, it is not always clear how and to what degree the Bank participated in these credit relationships. This article clarifies the Bank’s role by exploring some of its more technical lending functions.[4]

Although many white southerners applauded Jackson’s eventual destruction of the Bank, the Bank’s financial instruments helped commercially-oriented white southerners—principally planters, factors, slave traders, and merchants—operate within chaotic networks of credit and exchange that promoted economic development. In purchasing credit instruments known as bills of exchange in return for issuing its own notes, the Bank propagated a stable and uniform currency. Bills of exchange functioned as earning assets within banks’ vaults, enabled merchants to pay for imported manufactured goods from Great Britain, and allowed planters to receive payment for their crops well before consumers purchased them.[5]

How the Bank Worked

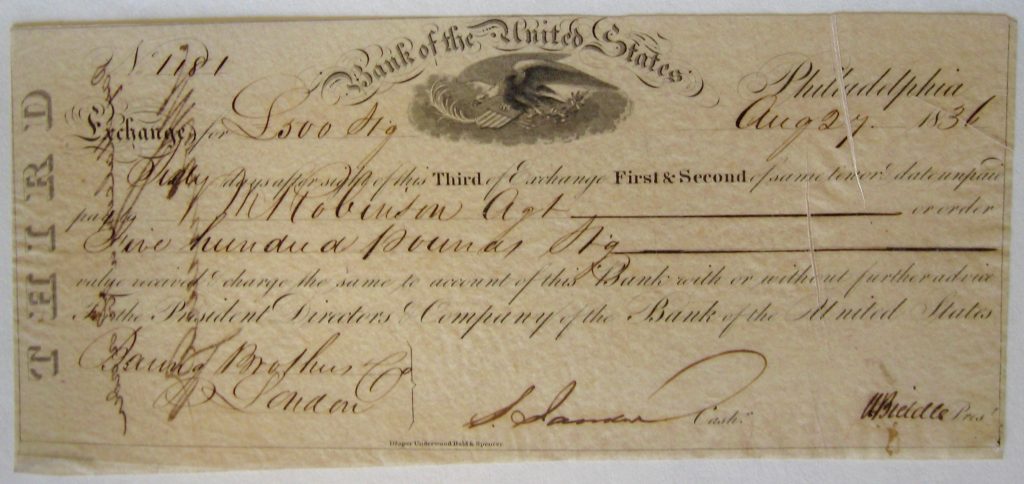

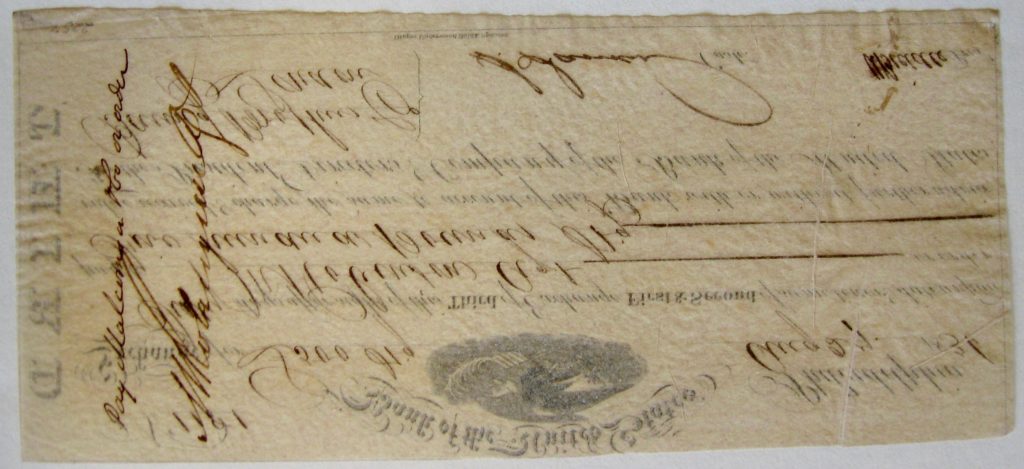

As early as 1820, the Bank’s board of directors recognized that the economies in the South and West suffered from an inadequate supply of sound bank notes. It therefore started issuing several million dollars worth of so-called “branch drafts” in denominations of five, ten, and twenty dollars. The BUS also facilitated commerce along the Mississippi and Ohio valleys by circulating credit instruments known as bills of exchange, short-term (60-90 days), liquid, interest-bearing orders.[6] Bills of exchange were monetary representations of the value of agricultural exports and commercial imports. Like the bank notes that functioned as cash in antebellum America, bills passed from hand to hand, but unlike the former, they required endorsements (signatures) for each transaction. When he became president of the Second Bank in 1823, Nicholas Biddle directed the BUS branch offices to buy and sell millions of dollars of these financial instruments. The BUS became the nation’s largest dealer in domestic and foreign bills of exchange under Biddle’s tenure.[7]

Factors, planters, merchants, and other actors who engaged in long-distance trade used bills of exchange to avoid the time, risk, and hassle of transporting specie over long distances to pay for goods.[8] Let’s say a Mississippi planter wished to buy manufactured goods for his plantation. After the fall harvest, the planter gave his cotton crop, worth approximately $1,000, to a factor for shipment to New Orleans. The factor then drew up a bill of exchange for $1,000, payable in 90 days, drawn on the BUS branch in New Orleans, and gave it to the planter. With bill in hand, the planter then walked into the Second Bank’s branch office in Natchez. The bank would take possession of the bill, deduct interest up front, and give the planter $985 in bank notes, discounting 6% for the risk that the factor would be unable to pay back the loan. At the end of the ninety days, the factor paid back the full $1,000 to the bank. The BUS thus provided planters and other actors with cash that they could use to buy crops, slaves, tools, land, and other commodities, and all before their cotton was ultimately sold in Great Britain.[9]

By buying and selling large quantities of bills of exchange—and then transferring them back and forth between various branch offices—the BUS provided financial services that served the needs of southern planters and northeastern merchants at very low cost to both. During the winter and spring months, when cotton was moving to market for export, the BUS branches in the South purchased foreign bills of exchange drawn on (or payable in) London. The BUS would then ship these bills up to its northeastern branches, which sold them to American import merchants. By the summer and fall, the merchants would use these bills to pay for manufactured goods, which were then arriving from Great Britain. Meanwhile, the bank’s southern branches had issued notes to planters as part of the discount process. Planters could then pay their debts to southern merchants, who reimbursed northeastern creditors, who in turn, sent remittances to merchant banking houses. Over the course of the year, bills of exchange and bank notes flowed in a northeasterly direction.[10]

A number of important consequences stemmed from the Bank’s extensive bill brokering operations. Interregional lending rates could be equalized, prices could be stabilized, seasonal fluctuations in trade could be smoothed out, and cash-starved regions in the South and West could obtain needed credit. The BUS extended credit in ways that no state bank could match while at the same time outcompeting private exchange brokers who charged higher rates for discounting.[11] Without the Bank’s services, the availability of bills of exchange during certain months of the year would have run dry. Merchants would have needed to ship specie to pay for goods, which was time-consuming and costly to insure. At least one economic historian has pointed out that by reducing the cost of interregional and international trade, the BUS contributed to the nation’s economic growth.[12]

Bills of Exchange, Slavery, and the History of Capitalism

As historians of capitalism have demonstrated, the sale of public lands and expansion of the cotton kingdom in the antebellum era depended on the tragic and forced removal of Native Americans. Another forced removal—that of 800,000 to 1 million African Americans along the infamous domestic slave trade—took place contemporaneously.[13] In boom times, a cyclical pattern emerged: planters bought slaves to pick cotton on new lands they had just purchased, sold the cotton, and used the profits from cotton and land sales to buy more land and more slaves.[14] Historian Calvin Schermerhorn viewed Biddle as “slaveholders’ best unpraised friend of the [1820s].”[15] Because the Bank’s various branch offices sent credit instruments and precious metals back and forth between one another, a commission merchant in New Orleans, for example, could more easily buy a slave in Maryland. This was the case with Hector McLean, who in 1820 paid $1,500 for the purchase of five slaves from slave trader David Anderson in Maryland. Rather than wait three to four months for payment to arrive from McLean, Anderson could immediately pay a small fee to discount a bill of exchange at the Baltimore branch BUS, which then sent a bill of exchange to the New Orleans branch.[16]

While slave buyers could pay for slaves with any number of credit instruments, they often preferred using commercial paper drawn on northern financial institutions like the BUS because southern notes, bills, and checks tended to depreciate more in value. The liquidity of the Second Bank’s notes and bills was also an advantage because slave traders often had to make quick sales to pay for their debts.[17] Because of its system of branch offices and abundant monetary resources, the BUS was far more equipped than any other bank in the country to facilitate the interregional lending that large slave trading firms required. Historian Edward E. Baptist found that Franklin & Armfield, the nation’s largest slave-trading firm, drew up to $40,000 at a time from the BUS to buy more slaves in the Upper South and estimated that about five percent of all the commercial credit handled by the BUS in 1831-1832 passed at some point through the hands of the firm.[18] It is interesting to note that Franklin & Armfield opposed the BUS, suggesting that slave traders could benefit from an economic infrastructure established by the BUS without reciprocating their appreciation.[19]

The Second Bank’s ability to funnel British capital into the South was a further boon to the slave economy. In the 1820s, British investment started flowing to the United States, in part because Biddle established a positive reputation within the financial community. Baring Brothers, a prominent London-based merchant banking house, established a partnership with the BUS to help service the nation’s public debt. Major brokerage firms purchased US treasury bonds from the BUS and marketed them to Barings in London money markets. Through Barings’s credit and the Second Bank’s commercial facilities, southern planters were linked with British manufacturers, including all of the importers, factors, commission agents, exchange dealers, exporters, and insurance agents in between.[20]

As Schermerhorn and others have pointed out, the supply chain of credit stretching from London to Liverpool to New York to New Orleans ultimately depended on assigning a cash value to the two most lucrative commodities of early-19th century capitalism: cotton and slaves.[21] Americans could not use their own bank notes to settle foreign debts, but foreign bills of exchange in pounds sterling, helped Americans obtain British credit, buy British manufactured goods, and make payments to the British bondholders who owned American securities. When they accepted these foreign bills, the Bank of England and Barings granted generous lines of “open credits” to American import merchants, allowing them to satisfy Americans’ consumptive habits by borrowing without security on a continual basis.[22] In London money markets, it was the purchase of American securities—the stocks and bonds that capitalized banks, internal improvements, and railroad companies—that financed much of the westward expansion in the United States. These high-yield securities played an important role in the balance-of-payments between Great Britain and the United States. The system worked so long as the price of cotton remained relatively stable.[23]

The BUS leveraged these financial connections to northern and British capitalists to invest a great deal of money in the American South, particularly the Old Southwest. The Bank’s discounts, note circulation, and bills of exchange were concentrated disproportionately in slave states. From January 1, 1832 to January 1, 1833, all of the Bank’s branches purchased approximately $67.5 million in bills of exchange. Of this sum, $46.3 million, or 68.6%, was purchased at branch offices located in slave states. In February 1832, more than two out of every three BUS notes (67.9%) were issued by branches located in slave states.[24] An examination of the Bank’s balance sheets shows that the branch offices located in the Mississippi and Ohio valleys purchased the most bills of exchange and were the most profitable. The point of purchasing these bills was to keep farmers and planters afloat through loans between the spring planting and the fall harvest.[25]

No other branch office demonstrated the Second Bank’s influential presence in the American South more than the one located in New Orleans. Of the $67.5 million in domestic bills of exchange purchased at all twenty-four branches in 1832, $13.25 million, or 19.6%, was purchased at this branch. The “mother” or “parent” branch in Philadelphia, which purchased the second-most, handled less than half of this amount. These figures were roughly in line with the number of bills purchased at each office in 1822 and 1833.[26] They lend empirical support to the claims made by historians of capitalism that the hot spot of the economic boom fueling the industrial revolution in the mid-1830s, at least in terms of raw materials, was indeed the Old Southwest. As goods from Pittsburgh, Cincinnati, Louisville, Nashville, and St. Louis all migrated down the Mississippi River, the New Orleans branch would purchase bills for all of the interior branches. In return, BUS notes flowed upstream. Simultaneously, northerners paid for southern produce by sending drafts—written orders to pay—to the South, which were drawn on banks in northern cities. The BUS thus facilitated a circular motion of trade that linked the urban Northeast, New Orleans, and the Mississippi and Ohio valleys.[27]

BUS notes maintained an essentially uniform value in every part of the union—a benefit to planters and merchants that stemmed from the Bank’s peculiar institutional structure. At a time when most businesses were small partnerships operating with only a local or regional presence at best, the BUS employed a nationwide army of over 500 agents and over 200 directors through its network of 30 branch offices and commercial agencies. The Bank stood alone in its national reach within an economy that was otherwise decentralized and seasonal. Because Americans could use the Bank’s notes to pay for all public duties, including customs duties and land sales, BUS notes attained an aura of confidence and stability. To the extent BUS note holders could expect to convert paper to gold or silver on demand, the Bank was an intangible but essential part of economic growth.[28]

Only in very rare cases did the

BUS participate directly in the buying and selling of human beings—a tragic

feature built into the legal system because corporations could acquire property,

including slave property, during bankruptcy and the settlement of debts.[29] Yet there is no doubt that the financial instruments and credit

facilities of the Second Bank of the United States promoted southern and

national economic development in the antebellum era. The BUS was one among many

financial institutions that pooled together northern and foreign capital to

provide an interregional and international credit infrastructure that helped white

southerners extend slavery westward and entrench it in the national political

economy.

[1] For more on the political dimensions of the Bank War with a particular emphasis on the business of newspaper editors, see Stephen Campbell, The Bank War and the Partisan Press: Newspapers, Financial Institutions, and the Post Office in Jacksonian America (Lawrence, KS, 2019).

[2] This article defines the South as the group of all slaveholding states, including Missouri, Kentucky, and Maryland. It defines the Old Southwest as primarily encompassing Louisiana, Mississippi, and Alabama.

[3] Key texts in the history of capitalism subfield include Seth Rockman, Scraping By: Wage Labor, Slavery, and Survival in Early Baltimore (Baltimore, 2008); Michael Zakim and Gary J. Kornblith, ed., Capitalism Takes Command: The Social Transformation of Nineteenth-Century America (Chicago, 2012); Joshua Rothman, Flush Times and Fever Dreams: A Story of Capitalism and Slavery in the Age of Jackson (Athens, GA, 2012), 14-24; Walter Johnson, River of Dark Dreams: Slavery and Empire in the Cotton Kingdom (Cambridge, 2013); Edward E. Baptist, The Half Has Never Been Told: Slavery and the Making of Capitalism (New York, 2014); Sven Beckert, Empire of Cotton: A Global History (New York, 2014); Brian P. Luskey and Wendy A. Woloson, ed., Capitalism by Gaslight: Illuminating the Economy of Nineteenth-Century America (Philadelphia, 2015).

[4] Confusion over understanding the credit system stems from a variety of factors. There are few modern parallels to this system, with its hundreds of hundreds of state-chartered banks, each circulating their own currencies of differing qualities and values backed by gold and silver. Contemporary financiers corresponded with one another in ways that appear to modern readers as dense, technical, and borderline unintelligible. Moreover, bank balance sheets and bank-related commentary from financiers and politicians did not evince a uniform terminology. One financial statement might say “bills discounted on personal security” in one congressional report while another might say “notes discounted” when both described the same transaction. For example, compare the statements presented in H. R. Rept. No. 460, Serial 227, 267, with Senate Document No. 17, 23rd Congress, 2nd Session, Serial 267, 128. Sharon Ann Murphy’s recent book was part of the “How Things Worked” series with Johns Hopkins University Press. The title of the series indicates that there is some agreement among the scholarly community for the need to explain difficult topics in digestible language. Part of the impulse of writing this article is to provide that explanation. See “Other People’s Money: How Banking Worked in the Early Republic,” SHEAR blog post by Mark Cheathem, May 16, 2017, at: http://www.shear.org/2017/05/16/other-peoples-money-how-banking-worked-in-the-early-republic/ accessed June 30, 2017.

[5] Recent studies that explain some of the Bank’s lending activities include Richard Holcombe Kilbourne, Jr., Slave Agriculture and Financial Markets in Antebellum America: The Bank of the United States in Mississippi, 1831-1852 (London, 2006); Scott Reynolds Nelson, A Nation of Deadbeats: An Uncommon History of America’s Financial Disasters (New York, 2012), especially 100-125; and Jane Ellen Knodell, The Second Bank of the United States: “Central” Banker in an Era of Nation-building, 1816–1836 (London, 2017).

[6] Condy Raguet, A Treatise on Currency and Banking (Philadelphia, 1840).

[7] S. Doc. No. 17, 25–26; H. R. Rept. No. 121, Serial 236, 3, 163; Walter B. Smith, Economic Aspects of the Second Bank of the United States (Cambridge, 1953), 39–44; Ralph Charles Henry Catterall, The Second Bank of the United States (Chicago, 1902), 137-143.

[8] “Merchant” was a generic term that could refer to any number of occupations, including a traveling peddler, an owner of a country store, a dry-goods retailer, an exporter, a wholesale jobber devoted to one particular line of goods, or an importer. In the context of the antebellum South, factors, sometimes defined as commission merchants or middle men, were financial intermediaries that extended credit to planters. As such, they provided information on business conditions, discounted credit instruments, purchased supplies, sold merchandise, kept business records, and endorsed notes, bills, and drafts. Factors charged a commission for helping planters market crops in distant commercial areas like New Orleans, which involved transportation and insurance. Nelson, Nation of Deadbeats, 100-125; George D. Green, Finance and Economic Development in the Old South: Louisiana Banking, 1804-1861 (Palo Alto, 1972); Edward J. Balleisen, Navigating Failure: Bankruptcy and Commercial Society in Antebellum America (Chapel Hill, 2001), 2, 28.

[9] The example I have provided is a simplified version demonstrating only one component of a complex network of trade and credit instruments involving several financial institutions. For the purposes of clarity and space, I have omitted the steps involving the “protesting” of bills. I have deliberately simplified this model out of a belief that at least part of what causes confusion for those who are trying to understand this system lies in the fact that so many different actors and transactions were involved in the shipment of southern cotton to British textile factories. In the accounting parlance of the times, “drawn on” or “drawn against” meant that the credit instrument, once negotiated, or cashed, would deduct funds from that particular locale.

[10] H. R. Rept. 460, Serial 227, 315-333.

[11] Register of Debates, 21st Congress, 1st Session, House, Appendix, 118-120.

[12] Knodell, The Second Bank of the United States, 69–73, 160.

[13] Beckert, Empire of Cotton, 218-223.

[14] Rothman, Flush Times and Fever Dreams, 23-24.

[15] Calvin Schermerhorn, The Business of Slavery and the Rise of Capitalism, 1815-1860 (New Haven, 2015), 100.

[16] Ibid., 45-52.

[17] Steven Deyle, Carry Me Back: The Domestic Slave Trade in American Life (Oxford, 2005), 129.

[18] Baptist, The Half Has Never Been Told, 94 and 239.

[19] Schermerhorn, The Business of Slavery and the Rise of Capitalism, 1815-1860, 124-160.

[20] Peter Austin, Baring Brothers and the Birth of Modern Finance (London, 2007), 19-31.

[21] Schermerhorn, The Business of Slavery and the Rise of Capitalism, 1815-1860, 1-3.

[22] H. R. 460, Serial 227, 55-57. Austin, Baring Brothers, 47; 141; 149-150; Jessica M. Lepler, The Many Panics of 1837: People, Politics, and the Creation of a Transatlantic Financial Crisis (Cambridge, 2013), 17; Nelson, A Nation of Deadbeats, 119.

[23] Leland Hamilton Jenks, The Migration of British Capital to 1875 (New York, 1927), 66–95.

[24] Niles’ Weekly Register, June 1, 1833. H. R. 460, Serial 227, 269. Calculations performed by author.

[25] Niles’ Weekly Register, July 19, 1834; H. R. Rept. No. 121, Serial 236, 45–46; S. Doc. No. 17, Serial 267, 126–140. Knodell, The Second Bank of the United States, 79; Howard Bodenhorn, State Banking in Early America: A New Economic History (Oxford, 2003), 72–94, 219–249.

[26] S. Doc. 17, Serial 267, 192; Niles’ Weekly Register, June 1, 1833. Calculations performed by author.

[27] Smith, Economic Aspects of the Second Bank, 33. H. R. Rept. 460, Serial 227, 316. Samuel Jaudon to Biddle, May 16, 1832, Biddle Papers.

[28] S. Doc. No. 17, 23rd Congress, 2nd Session, Serial Volume 267, 311–312; H. R. Rept. 460, Serial 227, 315. For the importance of confidence and reputation in lending and the larger economy, see Naomi Lamoreaux, Insider Lending: Banks, Personal Connections, and Economic Development in Industrial New England (Cambridge, 1994); Lepler, The Many Panics of 1837, 94-122; Murphy, Other People’s Money, 77-102.

[29] For one example of the BUS acquiring slaves, see H. R. Rept. 460, Serial 227, 531-532.

Stephen Campbell

Stephen Campbell